New York State Realty's Blogs

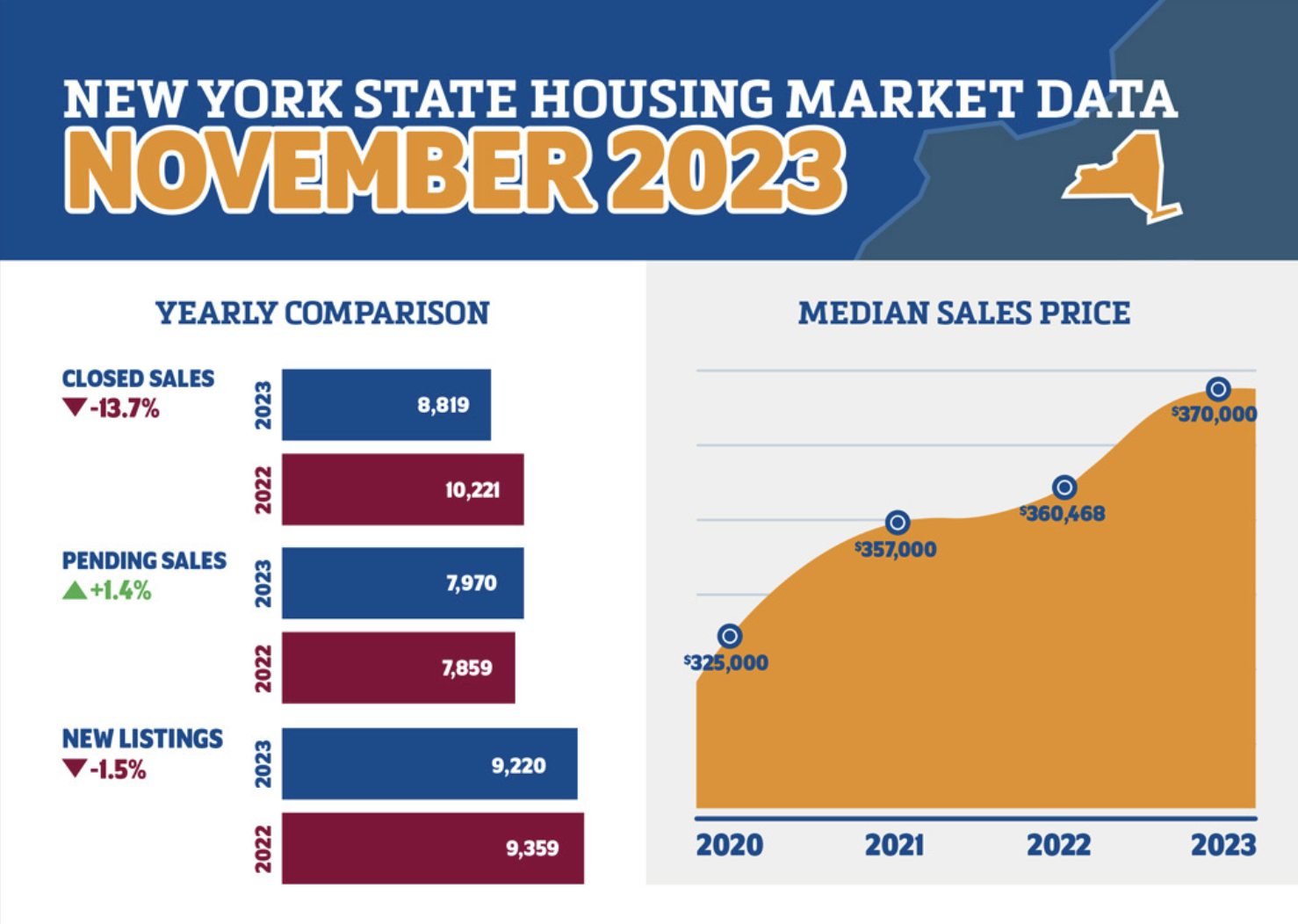

Albany, NY – December 20, 2023 – Inventory of homes across the Empire State fell to record lows in November while elevated sales prices slowed New York’s housing market even more, according to the housing report released today by the New York State Association of REALTORS®.

Inventory of homes for sale fell to an all-time low of 27,779 units in November. This marks a 20.7 percent decline in the 35,029 homes available in November 2022.

Median sales prices were up for the fourth consecutive month...

When an 18% decline in home sales in 2022 is followed by what looks like another 18% drop this year, it’s hard to put a positive spin on the residential real estate market going forward, but Dr. Lawrence Yun, chief economist for the National Association of REALTORS® (NAR), did just that on Dec. 12 at NAR’s annual virtual Real Estate Forecast Summit: The Year Ahead.

Yun predicted affordability to start improving in 2024, with a slight softening of home prices, hopefully making it easier for first...

Welcome Home for the Holidays… This Newley updated 4 bed 2 full bath is ready for a new family to move right in. With plenty of room to entertain , extra office area and mud room , and first floor laundry this home has all the old charm with new added updates .

To view additional photos, pricing and property details click on the following link https://www.newyorkstaterealty.com/real-estate/new-york-state-alliance-mls/residential/property/b1513234-43-dirkson-avenue-west-seneca-ny-14224/

While most Americans might dream of buying a home, today’s high interest rates have prompted many to hit pause and ponder: Is now really the right time to buy, or should I wait?

The concern is understandable. In late October, rates for a 30-year fixed-rate mortgage reached a 23-year high of 7.79%. That’s more than double the rates two years earlier, adding approximately $1,000 to a typical monthly mortgage bill (assuming a 20% down payment).

Since then, mortgage rates have nudged down, but many...